Best Car Insurance Rates

Why do you need car insurance?

The National Highway Transportation Safety Administration estimates that there are over 6.7 million car crashes every year in the United States at a total cost to our economy of over $242 billion. The average cost of a fatal car crash is over $1.3 million and even the average fender bender cost is about $3,500. In other words, the cost of a car accident can be financially ruinous not only for a driver and their family, but for any others involved in a crash. For that reason, virtually every state requires auto insurance in order to operate a vehicle legally within their borders. Car insurance is a financial product that spreads risk and protects against potentially catastrophic financial losses.

Types of Car Insurance

Automobile insurance carriers offer a variety of different ways to insure you and your car. The most basic type of coverage is called Liability insurance. Liability will help cover the costs of damage to other people and their property that results if you caused an auto accident. Most states will dictate a minimum level of Liability insurance a driver must pay, but most providers can offer you policies that will cover higher amounts of damages.

Collision insurance will help cover the costs of repairing your vehicle in the event of an accident. In the event that your vehicle is considered totaled (the cost of repairs exceeds the actual book value of the car), Collision may help replace your car. Although this coverage is optional if you won your vehicle, it is often required if you lease your car.

Comprehensive insurance protects drivers from damage that may arise from other factors, such as theft, storm damage, vandalism, hitting an animal, and others. It is frequently bundled with Collision insurance and is often a required type of coverage for leased vehicles. Most carriers can provide increased tiers of coverage in return for higher premium payments.

Personal Injury Protection (PIP) and Medical Payment (MedPay) are two similar products that can help cover the costs of medical bills if you and any passengers are injured in a crash. It can often cover as much as 80% of these costs. PIP is frequently known as “no fault” insurance, in that, as the name implies, it will cover you regardless of who caused the accident.

Unfortunately, some people will elect to drive without insurance and some medical bill can exceed the limits of your regular policy. Uninsured/Underinsured Motorist coverage is designed to kick in if you are hurt in an accident will an uninured driver. Many, but not all, states require drivers to carry this type of coverage in addition to basic liability.

There are also a suite of other, more specialized coverages available to motorists. For example, many carriers provide coverage in the event you need to temporarily rent a car while your own vehicle is being repaired. Emergency Roadside Assistance can help you if you have a flat tire, a dead battery or inadvertently lock your self out of your car. Some carriers can offer you Mechanical Breakdown insurance which acts, essentially, like an extended warranty on your car. There is Gap insurance which kicks in if your car is totaled and the amount of your car loan exceeds the amount your reimburses you in an accident.

As you can see, there is a wide range of ways to obtain financial protection as a motorist. As you would expect, you will pay higher premiums for these protections.

Average cost of car insurance by state

Car insurance is not a single priced commodity across the nation. The price you can expect to pay will be based on a variety of factors including your driving record, your age and gender, the make and model of your car, the level of financial protection you wish to carry and lastly, your place of residence. Heavily congested urban areas may have a more low speed fender bender accidents, while rural areas may have more open highway high speed crashes. The range of prices from low to high for average car insurance coverage covers a very wide range.

| Age | Typical Car Insurance Costs |

| 16 | $2,592 - $6,781 |

| 17 | $2,178 - $6,226 |

| 18 | $1,870 - $5,473 |

| 19 | $1,263 - 4,161 |

| 20 | $1,104 - $3,813 |

| 21 | $876 - $3,058 |

| 25 | $609 - $2,185 |

| 35 | $553 - $1,909 |

| 45 | $527 - $1,819 |

| 55 | $493 - $1,689 |

| 65 | $517 - $1,735 |

| 75 | $633 - $2,038 |

| 85 | $779 - $2,413 |

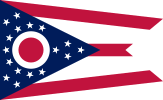

Keep in mind that although there are some federal commissions that offer insight and guidance when it comes to auto insurance, most regulation of the industry happens at the state level. Every state but one requires drivers to carry insurance (New Hampshire is the exception). And each state determines a certain minimum threshold of dollar coverage for policies. Some states require just plain Liability coverage, but some states have a legal requirement that drivers carry No-Fault insurance and possibly other levels of coverage. And different levels of coverage come at different price points. So, minimum coverage means different things in different areas of the United States.

Having said that, different carriers within the same state will charge different rates. As you can see, car insurance is a very variably priced Consumer good. Smart drivers look around for the best rates.

Where you Live Affects your Car Insurance Rates

The population density in any state will often be a determinant of the frequency of car crashes. Think about it. More cars on the road inevitably lead to more accidents. Rural states have fewer people in general and fewer cars on the road. More populous states may have congested highways where any small error in judgment while driving can result in an accident.

U.S. Cities with the Safest Drivers

| Rank | City and State |

| 1 | Fort Collins, Colorado |

| 2 | Brownsville, Texas |

| 3 | Boise, Idaho |

| 4 | Kansas City, Missouri |

| 5 | Hunstville, Alabama |

| 6 | Montgomery, Alabama |

| 7 | Visalia, California |

| 8 | Laredo, Texas |

| 9 | Madison, Wisconsin |

| 10 | Olathe, Kansas |

In addition, as we mentioned previously, some people will drive even without the required insurance. If uninsured drivers get into accidents it usually triggers expensive litigation to settle the question of who pays for injuries to people and property damage. This increases the rates for everyone. Remember, car insurance spreads the total economic cost of vehicular accidents with its domain across the pool of insurance policy holders.

U.S. Cities with the Most Dangerous Drivers

| Rank | City and State |

| 1 | Worcester, Massachusetts |

| 2 | Boston, Massachusetts |

| 3 | Washington, D.C. |

| 4 | Springfield, Massachusetts |

| 5 | Providence, Rhode Island |

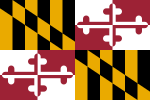

| 6 | Baltimore, Maryland |

| 7 | Glendale, California |

| 8 | Alexandria, Virginia |

| 9 | Philadelphia, Pennsylvania |

| 10 | New Haven, Connecticut |

Most Expensive States for Car Insurance

The average cost of auto insurance in the United States is about $1,500 per year but there is a wide spread between the most expensive and least expensive states for getting covered. The average policy cost in Michigan is over 42,200. The state requires every driver in the state to carry relatively high levels of Personal Injury Protection insurance, known as PIP relative to other states. Commonly known as No-Fault insurance, PIP helps cover medical bills resulting from an accident for the policyholder, family members, and passengers. This expanded coverage protects drivers within the state, but higher coverages mean higher premiums.

Louisiana, with average car insurance policy costs of around $2,100 has a very high percentage of motorists who drive without insurance (recent estimates are 13%). In addition a very high percentage of drivers in the state, 40%, carry only the minimum coverage mandated. In practical terms, many drivers in accidents resort to litigation to recoup costs of accidents. The litigation frequently results in awards that can greatly exceed what would have been covered under normal policies and insurers pass those costs along to consumers, driving rates higher. Florida, with average costs of just over $2,000 per year has a similarly high percentage of motorists who drive without insurance.

| State | Cost per year | Cost per month |

| Michigan | $5,316 | $443 |

| Florida | $2,565 | $214 |

| Rhode Island | $1,596 | $133 |

Cheapest States for Car Insurance

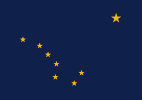

States with low population density have fewer cars on their roads and correspondingly fewer accidents. Fewer accidents means fewer payout for insurance companies and this allows them to provide coverage at a lower price point to consumers. The number of insurers operating within a state also impacts average rates. More insurers means more price competition between providers and fewer providers generally means higher average premiums.

Another factor is state insurance costs has to do with the number of people who drive without insurance. Insured drivers are covered up to a predetermined point. In an accident with an uninsured motorist, a driver can often wind op in lawsuits that raise the ultimate payout costs for the litigants. Iowa and Vermont are two states with the lowest average cost of all states with an average premium of right around $1,000 per year. Both states have relatively low rates of people driving without insurance.

However, keep in mind that state mandated minimum coverage levels vary. A policy that will pay you a maximum $15,000 per accident will of course be cheaper than a policy than covers you up to a higher amount. Generally speaking, lower populated rural states have lower insurance costs but different coverage levels make direct apples to apples comparisons tricky.

| State | Cost per year | Cost per month |

| Iowa | $384 | $32 |

| South Dakota | $420 | $35 |

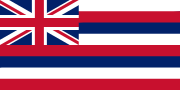

| Hawaii | $468 | $39 |

Car Insurance Trends for 2020

Car insurance rates have been trending upwards for several years now. There are a few factors driving those increase in auto insurance premiums. Over the past few years there have been many natural disasters across the United States. Wild fires, hurricanes, and record snowfalls result in car property damages much higher than norm. Insurance carriers factor these things into their rates but the higher incidences caused losses that they in turn pass on to their customers.

Car are also becoming loaded with high tech amenities and those items can add on to the expense of repair bills. Now a vehicle repair may need to replace computer components and screens in addition to bumpers and quarter panels. Consistently higher repair bills work their way into pricing plans from insurance carriers and are spread out across their customers.

The number of traffic and pedestrian fatalities have been ticking up in recent years and some believe that driver distraction may be behind at least some of the increase. The prevalence of smart phones, larger automobile data screens, GPS, devices etc. can distract a driver’s attention for the road, and it only takes a momentary lapse sometimes to cause an accident.

Since auto insurers must get state Insurance Commission approval for rate increases in most cases, the rates you pay this year are driven by what happened in the trailing years. And natural disasters, expensive amenities and increased accident rates all put upward pressure on insurance premiums. The outlook for 2020 is for this increase to continue.

Compare Car Insurance Rates Online

With all the variables involved in setting a rate for a car insurance premium, it is understandable if consumers can sometimes feel a little overwhelmed by it all. There is no single rate most consumers could expect to pay for their insurance needs. Your driving record, your place of residence, your age, the make and model of your car, your desired level of coverage – all of these things taken together will determine your premium. Insurance costs are tailored to your risk profile.

There are multiple companies within the auto insurance space in the United States, even in low populations states. A smart consumer will compare prices in order to see the range of prices you can expect to pay. Nowadays, virtually every carrier has an online presence to provide drivers with price quotes. Online tools can help you put your own personal risk profile across to multiple vendors and, in essence, make them compete for your business.

At General.com our easy to use online tool can help you get free quotes for most carriers. The days of just going with the first insurance provider you come across are gone for smart shoppers. Get no-cost, no-obligation online quotes and save money. It only takes a few key strokes to make sure you’re paying the lowest price you can.

Car insurance is something that will help to protect you if you drive a car. There are many things to know about it, and you have to find out everything you can if you are in the market for a car insurance plan. Here is some information about the top auto insurance companies out there.

Progressive Car Insurance

Progressive has “Flo” a charming lady who sells car insurance and other types of coverage. Progressive is another top provider of car insurance who strives for customer service excellence and rates that are as low as possible. The company was founded in 1937 so they have over 80 years of experience in providing car insurance. They have learned a lot over the years and are quite financially solvent, meaning they can pay out even in the event that there is a natural disaster and they need to pay out a lot of claims at one time. Progressive is one of the honest car insurance companies who will really tell you what is going on.

Compare Progressive vs The General: Who is the better in car insurance?

| Progressive | The General | |

|

Overal |

||

| Customer Experience | 9/10 | 10/10 |

| Pricing and Discounts | 8/10 | 9/10 |

| Financial Strength | 10/10 | 10/10 |

| Coverage & Benefits | 9/10 | 10/10 |

|

J. D. Power Ratings 2017 |

||

| Overal Satisfaction | 3/5 | N/A |

| FNOL | 3/5 | N/A |

| Claim Servicing | 3/5 | N/A |

| Estimation Process | 3/5 | N/A |

|

General |

||

| States served | All states | 46 States |

| Driver discounts | + | - |

| Vehicle discounts | + | - |

| Good Driver Discounts | Up to 31% | - |

| Good Student Discounts | - | - |

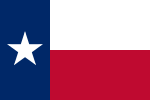

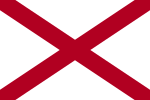

| Cheapest in | Alabama | Alabama |

The General Car Insurance

The General is a unique type of insurance company that also has a cute mascot. That seems to be an important theme in the success of car insurance providers. They are what might be considered a discount insurance provider but there is nothing discount about the service they provide. You may be able to save a lot of money on your current car insurance rates by checking out The General. They have been around and providing insurance for more than 50 years, so they know what they are doing by now.

The General Auto Insurance Quotes by States

The General is a car insurance company that caters to higher-risk drivers. Each state has different requirements for automobile insurance, and comparing rates for car insurance companies in the state you are living in is essential. The General offers fantastic customer service and competitive rates for high-risk drivers and others. Headquartered in Nashville, Tennessee, The General offers convenient monthly payments, quality claims handling, low down payments, and accepts most drivers and vehicles. With policies that satisfy the minimum limit requirements in your state, as well as the ability to add coverage to your plans as suits your needs, The General brings flexible offerings not only in terms of the policies that are offered but also in terms of payment methods and customer service. Get a free quote today.

The General Auto Insurance Coverage

The General is fantastic for drivers who would otherwise have a harder time obtaining insurance. There are numerous perks to getting a car insurance plan with The General, including having the ability to manage your insurance plan online. The General also offers an excellent mobile app so you can manage your policy on a phone or tablet as well. If you, or a person you are purchasing insurance for, has a history of automobile accidents, make sure to get a quote from The General. There are numerous policy types available. In addition to the standard auto insurance policies, The General offers rental reimbursement insurance, deductible waiver – safety equipment insurance, insurance for customer equipment, roadside assistance, and more.

The General Auto Insurance Discounts

The General offers numerous discounts. One of the discounts available to drivers is the Double Deductible discount. This doubles your deductible for the first month and a half of your policy, causing your insurance costs to decrease over the same period. After the initial period, your auto insurance deductibles returned to their normal levels.

Multi-policy discounts are also available, as well as a homeowner's discount regardless of whether you get insurance for your house with The General or not. Multicar discounts are also available, as well as discounts for having previous insurance. Paying for your full insurance plan in advance also gives a discount.

Payment Methods

The General accepts multiple different types of payments for convenience. In addition to accepting credit card payments and electronic checks, people can set up automatic online payment and debit card payments here at The General. In addition, multi-payment installment plans are also available. For those who prefer it, mail payment and mobile app payments are also available.

Whether you are looking to pay online, over the phone, or via mail, there are many ways to pay for insurance policies issued by The General. People can pay cash through their agents, and P2P payments are also available on plans.

Features And Services

With over 50 years of experience in the auto insurance industry, and offering fantastic service, The General provides 24/7 claims of services over the phone. Customer support is also available by phone, email, and online chat. Policyholders can access their plans, manage their automobile insurance policy, printout their insurance ID cards, and make payments online as well. With flexible and convenient payment plans and low prices for high-risk drivers, The General is committed to giving policyholders a top car insurance experience.

The General offers low down payments to policyholder’s. With discounts available, as well as services like customer equipment coverage, deductible waiver – safety equipment coverage, and rental reimbursement coverage, in addition to traditional coverage options, The General fits your needs. Get a free quote now; the whole process can be done quickly and easily.

Allstate Car Insurance

Allstate is another major insurance company that is well known for providing car insurance to many individuals. They have special programs that make their company attractive to some who are searching for car insurance. They even have an app with safe driving tips that can help you to gain discounts on your auto coverage simply by learning about how to be a better driver. They also offer accident forgiveness and discounts for safe driving, making them among the top choices. They may not be the cheapest choice for many but they are a popular one because of how much information they provide that is very helpful to drivers.

Compare Allstate vs Farmers: Who is the better in car insurance?

| Farmers | Allstate | |

|

Overal |

||

| Customer Experience | 10/10 | 10/10 |

| Pricing and Discounts | 9/10 | 10/10 |

| Financial Strength | 9/10 | 10/10 |

| Coverage & Benefits | 10/10 | 10/10 |

|

J. D. Power Ratings 2017 |

||

| Overal Satisfaction | 3/5 | 3/5 |

| FNOL | 3/5 | 3/5 |

| Claim Servicing | 3/5 | 3/5 |

| Estimation Process | 3/5 | 4/5 |

|

General |

||

| States served | All states | All States |

| Driver discounts | + | + |

| Vehicle discounts | + | + |

| Good Driver Discounts | + | Up to 22% |

| Good Student Discounts | B average or 3.0 GPA or higher | Up to 20% |

| Cheapest in | Arizona | Arizona |

Farmers Car Insurance

Farmers insurance is a great company that has been providing coverage for autos for more than 85 years. They are a company that knows about families and what you need to protect your family in the event of a car accident. They also have local agents and lots of flexibility over exactly what type of coverage you choose for your car insurance.

Add new comment